Introduction: Why Interest Rates Matter More Than You Think

If you’re buying or selling a home, you’ve probably heard the phrase “interest rates are up” or “the Fed just raised rates again.” But what does that mean for your real estate decisions?

Interest rates aren’t just numbers on a chart, they’re emotional triggers, affordability levers, and strategic signals. They shape how buyers behave, how sellers price, and how fast homes move. In this post, we’ll break down how interest rates work, why they change, and how they directly impact your mortgage, your sale price, and you’re timing.

Whether you’re a first-time buyer, a seasoned investor, or a homeowner wondering if now’s the time to sell, this guide will help you read the economic tea leaves with clarity and confidence.

📈 What Are Interest Rates, Really?

At their core, interest rates are the cost of borrowing money. When you take out a mortgage, you’re borrowing money from a lender—and the interest rate determines how much you’ll pay for that loan over time.

But here’s the twist: the rate you get isn’t just about your credit score. It’s influenced by broader economic forces, especially the decisions made by the Federal Reserve (aka “the Fed”).

The Fed’s Role

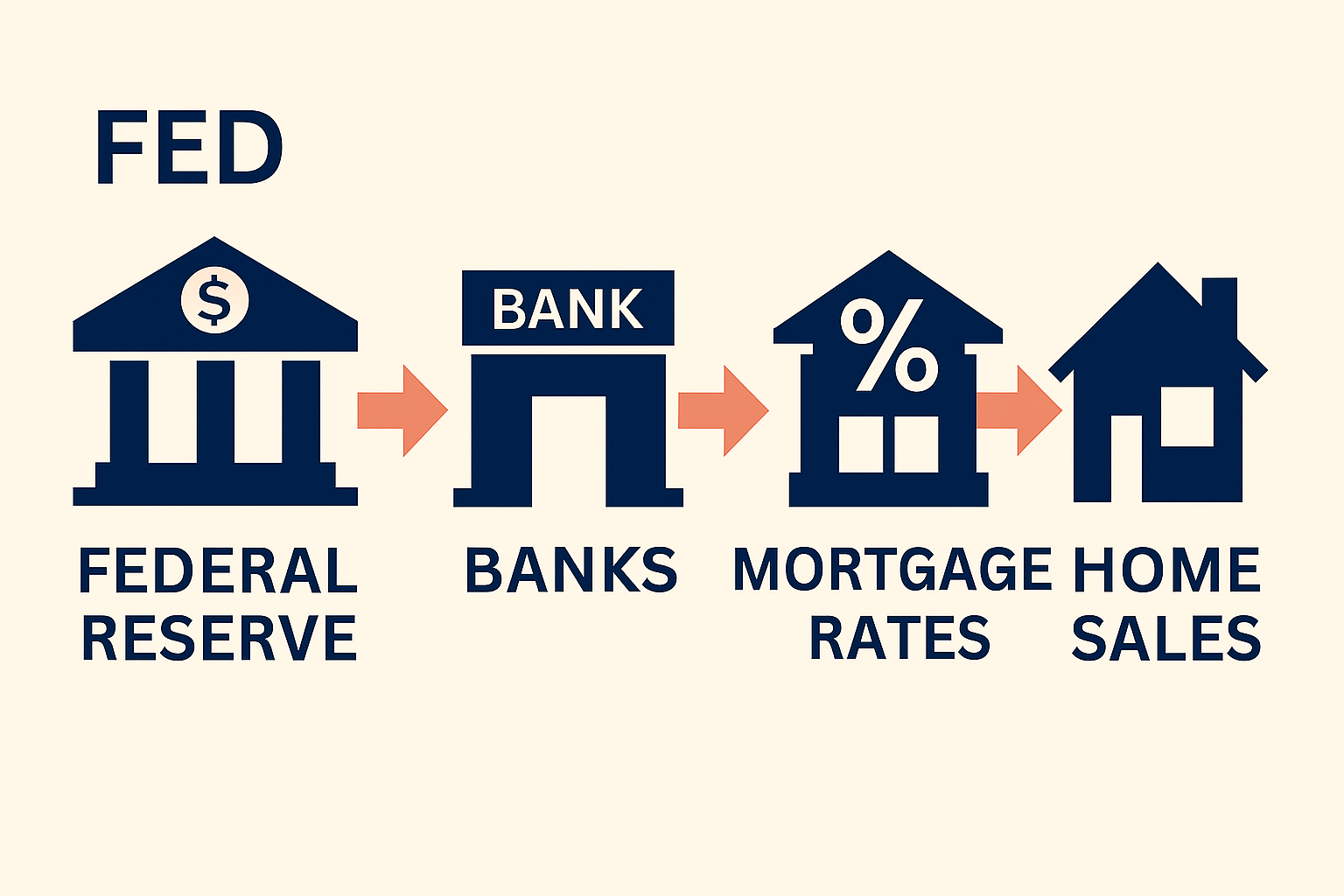

The Federal Reserve sets the “federal funds rate,” which is the interest rate banks charge each other for overnight loans. This rate trickles down into everything from credit cards to car loans—and yes, mortgages.

When the Fed raises rates, borrowing becomes more expensive. When it lowers them, borrowing gets cheaper. The Fed adjusts rates to control inflation, stimulate growth, or cool down an overheated economy.

🏠 How Interest Rates Affect Home Buyers

1. Mortgage Affordability

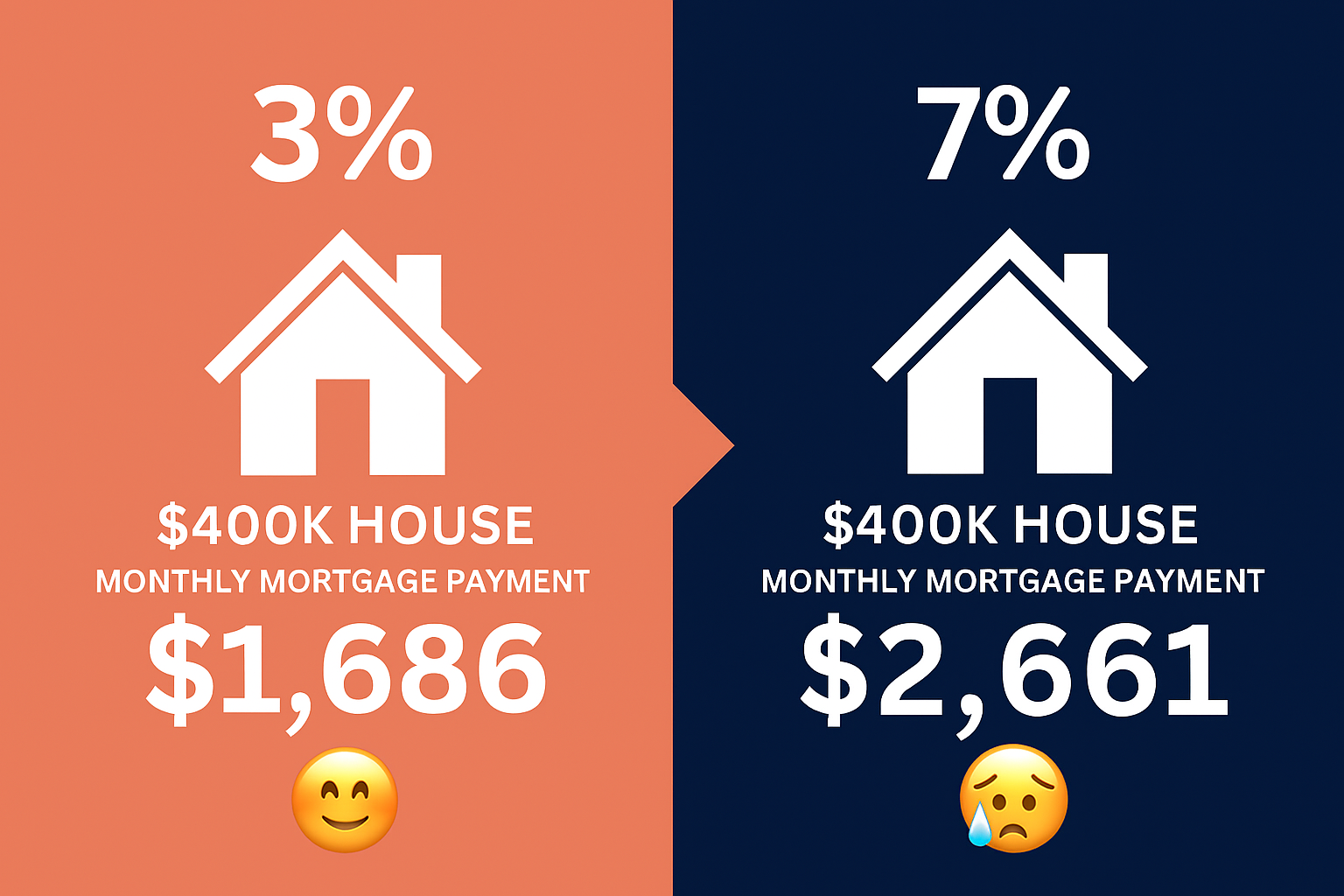

Let’s say you’re buying a $400,000 home. At a 3% interest rate, your monthly mortgage payment might be around $1,686. But if rates jump to 7%, that same home could cost you $2,661 per month, a difference of nearly $1,000.

That’s not just a budgeting issue. It’s a psychological one. Higher rates shrink buying power, which means:

- Buyers may lower their price range

- Some may exit the market entirely

- Others may delay purchases, hoping rates will drop

2. Loan Qualification

Higher rates also affect debt-to-income ratios. If your monthly payment rises, your lender may decide you can’t afford the loan—even if your income hasn’t changed.

This can lead to:

- More denied applications

- Smaller loan approvals

- Increased demand for adjustable-rate mortgages (ARMs)

3. Buyer Psychology

Interest rates shape urgency. When rates are low, buyers rush to lock in deals. When rates rise, they hesitate, negotiate harder, or wait for a “better time.”

This creates ripple effects on how fast homes sell and how competitive offers become.

🏡 How Interest Rates Affect Home Sellers

1. Pricing Strategy

When rates rise, fewer buyers can afford your home. That means:

- You may need to lower your asking price

- You might offer seller concessions (e.g., covering closing costs)

- You could consider financing incentives (like rate buydowns)

In high-rate environments, sellers must shift from “top dollar” expectations to “strategic pricing” that matches buyer sentiment.

2. Time on Market

Higher rates often mean longer listing times. Buyers are cautious, and competition thins out. This can lead to:

- More price reductions

- Increased staging and marketing efforts

- Emotional fatigue for sellers expecting quick sales

3. Negotiation Dynamics

In a low-rate market, sellers hold the power. In a high-rate market, buyers do. That means:

- Expect more contingencies

- Prepare for inspection requests and appraisal challenges

- Be ready to negotiate creatively

🧠 The Emotional Side of Interest Rates

Real estate isn’t just math—it’s emotion. Interest rates influence how people feel about money, risk, and timing.

- When rates drop, people feel optimistic and expansive.

- When rates rise, fear and caution creep in.

This emotional shift affects everything from open house attendance to offering strength. Sellers may feel “stuck” or “missed the window.” Buyers may feel “priced out” or “pressured to act.”

Understanding this emotional landscape helps agents and homeowners communicate with empathy and clarity.

🔄 Timing the Market vs. Understanding the Cycle

Many buyers and sellers try to “time the market”—waiting for rates to drop or prices to rise. But here’s the truth: timing is nearly impossible. What’s more effective is understanding the cycle.

Economic Cycles and Real Estate

The economy moves in cycles: expansion, peak, contraction, and recovery. Interest rates rise during expansion and fall during contraction and recovery.

Real estate follows these cycles, but with a lag. That means:

- Rates may rise before prices fall

- Prices may stay high even as buyer demand drops

- Recovery may begin before rates fall again

By understanding where we are in the cycle, you can make informed decisions—not emotional ones.

💡 Smart Strategies for Buyers and Sellers

For Buyers:

- Get pre-approved early to lock in rates

- Consider ARMs or rate buydowns if you plan to refinance later

- Focus on long-term value, not short-term rate fluctuations

For Sellers:

- Price strategically based on buyer affordability

- Offer incentives like closing cost credits or rate buydowns

- Be flexible and responsive to market feedback

🛠 Tools to Help You Navigate

- Mortgage calculators: Run scenarios with different rates

- Local market reports: Track buyer activity and pricing trends

- Agent insights: Lean on professionals who understand the emotional and economic terrain

🧭 Interest Rates as a Compass, not a Barrier

Interest rates aren’t the enemy—they’re a compass. They help you understand where the market is heading, how buyers and sellers are feeling, and what strategies will work best.

Whether rates are rising or falling, there’s always opportunity. The key is to stay informed, stay flexible, and make decisions based on your goals—not just the headlines.

If you’re ready to buy, sell, or simply understand your options, learn the basic principles first. The market may shift, but your clarity doesn’t have to.

If you are selling, grab the 78-page eBook written for agents, investors, and homeowners. It’s called “Sell Your Home in Days, Not Months. It covers the essential listing need to know items, also, if a home is on the market too long, what needs to happen, and much more.

Here is an overview of what’s in this book:

This book strips away the fluff and delivers a proven system that works in any market. Inside, you’ll learn:

- ✅ How to emotionally detach and prepare your home for a buyer’s eyes—not your memories

- 📸 The power of visual storytelling through staging, photography, and marketing that sells

- 💬 Scripts and strategies for handling buyers, agents, and tough conversations with grace

- 🧠 Mindset shifts that help you stay focused, clear, and in control throughout the process

- 📦 Practical checklists and timelines to move from “just listed” to “just sold” in record time

Get your copy today, it’s just $14.00.